North America's Record Breaking Power Demand

Electricity demand across North America is hitting historic highs, with U.S. forecasts showing record power consumption in 2025 and continued growth into 2026. This matters for Canadian large industry as pricing is highly influenced by North American natural gas markets and, increasingly, cross-border grid dynamics.

As demand pushes higher, system operators on both sides of the border are now signaling that load growth is moving faster than generation additions creating a structural shift that directly impacts pricing, risk management, and long-term planning.

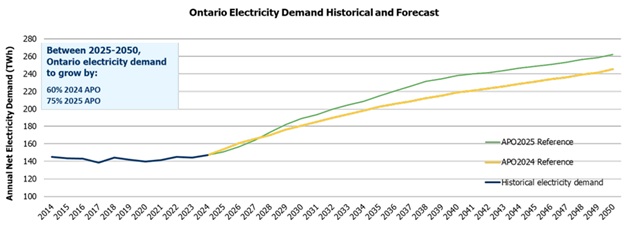

Figure 1: IESO Forecast

Why electricity demand is soaring

Several long-term trends are converging:

- AI and data centers: Hyperscale facilities now consume the load of small cities, creating continuous baseload demand.

- Industrial and fleet electrification: Growth in electric boilers, heat pumps, and EV charging adds steady new load across manufacturing and logistics.

- Generation mix changes: Coal continues to retire, leaving natural gas as the primary marginal fuel while renewables ramp up.

Implications for pricing

1. Higher marginal prices during peak hours

As gas-fired plants run more often to meet rising demand, they increasingly set the market-clearing price. Industrial customers should expect more hours of elevated pricing, especially during seasonal peaks and periods of system stress.

2. Stronger electricity–natural gas price linkage

Record power demand drives higher gas usage. That creates tighter gas markets, amplifying volatility in both commodities and pushing industrial operating costs higher when demand surges.

What this means for large industrial consumers

Most forecasts point to structurally higher electricity prices over the next decade as load continues to grow faster than firm supply and transmission expansions. Industrial consumers can expect wider spreads, more price spikes, and stronger hour-to-hour variability, especially in Alberta and Ontario.

Facilities capable of shifting or curtailing load, even modestly, will benefit from:

- reduced exposure to high-cost hours,

- incentive programs tied to grid stability,

- and stronger negotiating positions in supply contracts.

Looking ahead

The most important takeaway is simple: a kilowatt-hour is becoming more valuable.

Record-breaking demand growth, the rapid electrification of industry, and ongoing shifts in the generation mix mean Canadian industrial customers face a decade defined by tighter supply, greater volatility, and higher marginal costs.

Organizations that proactively adapt—through strategic procurement, efficiency investments, on-site generation, and flexible load operations—will be better positioned to maintain competitiveness in an increasingly constrained energy landscape.