Record Volatility

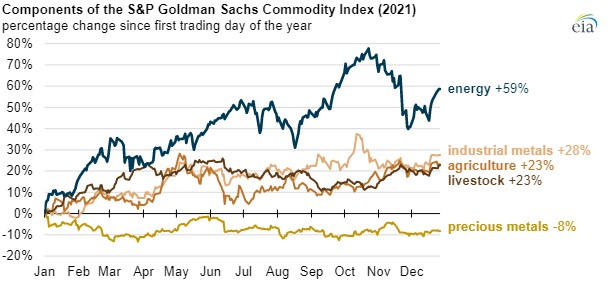

Record Pricing! This seems to be a common description of all energy commodities at this time. With the World in a state of uncertainty the steady eddy Energy markets have been pulled into the whirlwind and are now seeing volatility like never before.

The major impact from the Russia-Ukraine conflict is sending ripples through all markets as we see the traditional energy distribution supply chains crumble.

Although the fundamentals in North America haven’t changed much since 2021, the impact of what’s happening globally has created the uncertainty in the energy market as a whole and has created massive volatility.

North American Fundamentals:

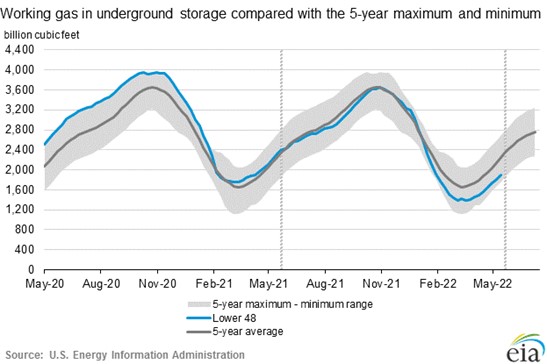

Storage:

When looking at a driving price indicators storage has always been a key metric. Currently we are 17% lower than this time last year and 15% lower than the 5 year average. There have been many years in the past where we have come out of the winter low in storage but never has this shortage lead to such a large increase in pricing.

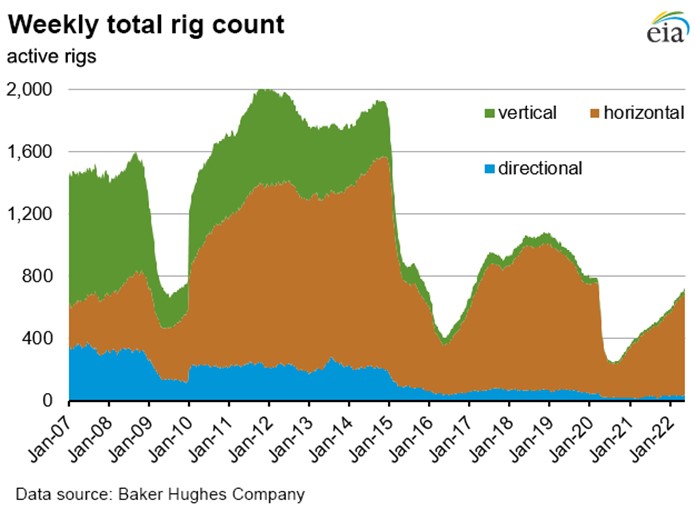

Production:

US production is ramping up heavily to meet the demand of the global market. Rig counts are climbing back to pre-pandemic levels as producers work to fill the shortage in the storage position.

Demand:

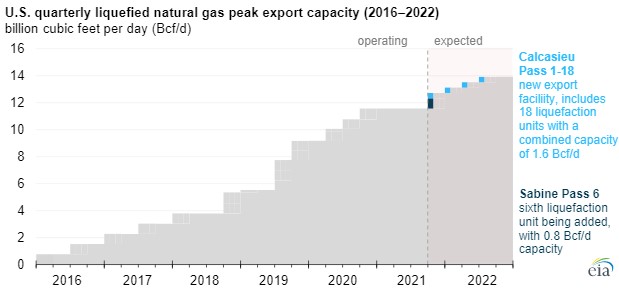

One of the key factors changing year over year on the demand side is the export of LNG from the US. With more terminals coming online in 2022 the US is now in a position where it will be a net exporter of Natural Gas.

This combined with the switch from coal fired power plants to those running on natural gas, we are seeing the largest uncertainty in the supply/demand dynamics come from the demand side.

Summary:

The volatility caused from the uncertainty in the market has been a difficult sea to navigate. When looking at purchasing strategies we always weigh all sides of the market to ensure we’re making the right decision at the right time. Given there seems to be no end in sight to the high market conditions our team is actively looking at longer term hedging strategies to help lower near term pricing.

Our goal is to help protect our clients from the unforeseen spikes and work to create budget friendly plans that work for all.

As always please reach out if you’re looking for some insight into your billing or options for hedging pricing against the current market rates.